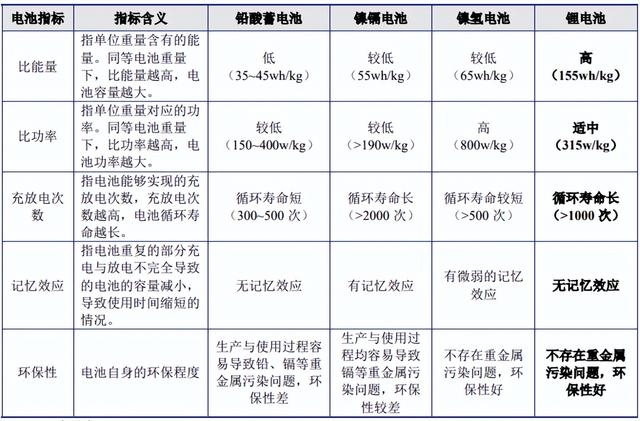

Lithium battery industry status, competition pattern, development history and future trend analysisIssuing time:2023-10-09 12:53 1, lithium battery introduction Lithium battery, also known as lithium-ion battery, is a secondary battery that relies on lithium ion (Li+) to move between the positive and negative stages to achieve the purpose of charging and discharging. Compared with other major secondary batteries, lithium batteries have obvious advantages such as high energy density, high discharge power, long cycle life, no memory effect and green environmental protection, as follows:

data source:GGII In the context of the great development of electric vehicles, electric light vehicles, power tools, consumer electronics and new energy storage industries, the comprehensive advantages of lithium batteries are in line with the increasing demand for large capacity, high power, service life and environmental protection in the downstream field, and there is a broad market application prospect. 2, the development of the lithium battery industry ① Development history of the global lithium battery industry In the early 1990s, the lithium battery developed by SONY Corporation of Japan was first applied to portable electronic products, which opened the preliminary exploration of the commercial application of lithium batteries in the world; In the early 21st century, with the popularity of consumer electronic products such as smartphones, MP3 and tablet computers and the improvement of lithium battery production technology, lithium battery shipments have grown rapidly, and the global lithium battery industry has entered a period of rapid development. In recent years, driven by new energy vehicles, electric light vehicles, power tools, new energy storage and other fields, the global lithium battery market space has maintained a rapid growth trend. ② Development history of China's lithium battery industry China's lithium battery industry started late, since the first introduction of lithium battery related technology in 1998, China's lithium battery industry has gone through 24 years of development, under the active guidance of national industrial policy and the joint role of domestic outstanding enterprises independent innovation, formed a relatively complete industrial chain and the world's leading market scale. A number of lithium battery head companies with international competitiveness and leadership have emerged, and Japanese and Korean companies that started earlier have formed a parallel pattern. 3, lithium battery industry status and future trends According to the terminal application, the downstream lithium battery can be mainly divided into three major areas of power, consumption and energy storage, among which, the main application areas of the power lithium battery are electric vehicles, electric light vehicles, electric tools, etc., which is the main application scenario of the current lithium battery (automotive power battery is also known as "large power battery", electric light vehicles/power tools with power battery is also known as "small power battery"); Consumer lithium batteries are mainly used in mobile phones, laptops and the recent rise of Bluetooth headsets, wearable devices and other consumer electronic products, is an important application field of lithium batteries; The energy storage lithium battery mainly provides support for the energy storage needs of communication base stations, user side peaking and valley filling, off-grid power stations, microgrids, rail transit, etc., which is a rapidly developing emerging field and the direction strongly supported by national policies in recent years. Benefiting from the rapid development of the three segments of power, consumption and energy storage, the lithium battery industry will continue to maintain a rapid growth trend, the development of each segment and the specific situation of the future trend are as follows: Driven by terminal applications such as new energy vehicles, electric light vehicles and power tools, the power lithium battery market has broad prospects Power lithium battery is currently the most important application market for lithium battery, mainly used in new energy vehicles, electric light vehicles, power tools three fields, the industry development of the driving factors are as follows: A. Technological advantages and policy dividends superposition, new energy vehicles boom, new energy vehicle power lithium battery market space is huge At the policy end, in the macro context of coping with climate change and promoting green development, new energy vehicles have become the recognized mainstream development direction with their obvious advantages in energy efficiency, environmental protection and intelligence. In October 2020, China issued the "New Energy Automobile Industry Development Plan (2021-2035)" to vigorously support the development of the new energy automobile industry, and proposed that by 2025, the sales volume of new energy vehicles in China will reach about 20% of the total sales volume of new vehicles. By 2035, pure new energy vehicles will become the mainstream of new sales vehicles, and the grand vision of comprehensive electrification of public sector vehicles will be realized. At the technical end, after years of policy encouragement and enterprise R&D and innovation, the technical level of domestic power battery enterprises has been continuously enhanced, laying the foundation for the long-term development of China's lithium battery market for new energy vehicles. In terms of international competitiveness, the market share of well-known enterprises such as Ningde Times and BYD ranks among the top in the world, and goes hand in hand with Japanese and Korean enterprises; In terms of continuous innovation, domestic lithium battery enterprises have successively launched new technologies such as CTP, blade battery, and JTM, and the technical level has been continuously improved. At the market end, the sales volume of new energy vehicles in 2022 was 6,886,600, an increase of 95.61% year-on-year, and the annual penetration rate increased from 13.4% in 2021 to 25.6%. The target of 20% penetration rate of new energy vehicle sales in 2025 in the "New Energy Vehicle Industry Development Plan (2021-2035)" is realized ahead of schedule, and the vision of "pure electric vehicles becoming the mainstream of new sales vehicles and comprehensive electrification of public sector vehicles" is advanced in 2035. In 2021 and 2022, the rapid development of the new energy vehicle market led to the rapid growth of China's lithium battery shipments for new energy vehicles, and the installed capacity achieved a year-on-year increase of 142.80% and 90.68%, respectively, maintaining a good growth trend. In the future, with the implementation of the new energy vehicle points system, the acceleration of the investment layout of traditional car companies in the field of new energy vehicles, and the continuous outbreak of new car manufacturing forces, China's new energy vehicle market will continue to maintain a rapid growth trend, and the supporting lithium battery shipments will continue to grow. B. The "new national standard", shared bicycles, express delivery and "lead to lithium" trend of multiple factors superimposed, electric light vehicle power lithium battery market continues to boom Electric light vehicles are an important part of the new energy transportation market, mainly including electric two-wheelers, electric tricycles, etc., among which, electric two-wheelers can be divided into electric bicycles, electric mopeds, electric motorcycles and two-wheel drive electric scooters and other products. In 2019, the output of electric two-wheelers in China reached 36.09 million units, forming a larger market scale. Due to historical development factors, the current electric two-wheeled vehicle battery in China is mainly lead-acid battery, compared with lead-acid battery, lithium battery has light weight, high specific energy, long cycle life, no memory effect and other advantages, the disadvantage is that the early cost is higher. With the improvement of the economy of lithium batteries, the penetration rate of lithium electric two-wheeled vehicles has increased year by year, from 4.40% in 2015 to 24.20% in 2021. In 2021, China's electric two-wheel vehicle power lithium battery shipments were 13.1GWh, an increase of 21.7%. In the future, the driving factors for the continued growth of lithium batteries for electric two-wheelers in China mainly come from two aspects: first, the further expansion of the market size of electric bicycles; Second, the penetration rate of lithium electric two-wheeled vehicles continues to increase. a. The market scale of electric bicycles has been further expanded In the field of electric bicycles, with the development of express delivery and instant distribution logistics market, China's electric bicycle market has grown steadily in recent years. According to Industrial Securities research report, China's electric bicycle production in 2020 reached 29.661 million units, an increase of 29.7%. In the future, on the one hand, the landing of relevant industry standards has improved the safety of the use of electric two-wheelers, and shared electric bicycles with legal road status have gradually received government support; On the other hand, with the release of the operation policy of the shared electric bicycle group, the standardization of the operation of the shared electric bicycle has been improved, and the amount of shared electric bicycles on Haro, Green Orange, Meituan and other platforms is expected to further increase. b. The penetration rate of lithium second wheel vehicles continues to increase in terms of the penetration rate of lithium second wheel vehicles, the "new national standard" and well-known enterprises will become the long-term help to accelerate the replacement of lithium batteries with lead-acid batteries. On the one hand, the official implementation of the "Safety Technical Specifications for Electric Bicycles" and "General Technical Conditions for electric Motorcycles and electric mopeds" in April 2019 has made specific requirements for the vehicle mass, battery voltage, motor power and maximum speed of electric two-wheelers, among which the mass of electric bicycles is required to be no more than 55kg. Ultra-specification vehicles will be regarded as electric motorcycles or electric light motorcycles and other motor vehicles for management, the use of the threshold has been significantly increased, one is that the driver needs to have a driving license, the second is that the difficulty of obtaining vehicle licenses has also increased. At present, the weight of lead-acid battery electric bicycle is generally more than 70kg, the weight of lead-acid battery is about 20kg, under the existing technology conditions, the weight of the same capacity lithium battery is only one-fifth of the lead-acid battery, the use of lithium battery can reduce the mass of the vehicle by more than 10kg. For end consumers, continuing to use bicycles equipped with lead-acid batteries will face a dilemma: choose electric (light) motorcycles with longer driving range, higher qualification requirements and stricter management; Or choose to sacrifice the range to meet the "new national standard" requirements. Therefore, the weight requirements of the new national standard for electric bicycles accelerate the replacement of lithium batteries for lead-acid batteries. On the other hand, many industry-leading battery companies have begun to lay out the field of electric two-wheelers. On the one hand, traditional lead-acid battery giants Tianneng Shares and Chaowei batteries have laid out lithium battery production capacity and made technical reserves for the replacement of lead-acid batteries by lithium batteries; On the other hand, lithium battery head companies, including Ningde Times, Lishen, Guoxuan High-tech, BYD, and Bic batteries, are actively laying out the field of small power cylinder batteries. The participation of relevant enterprises will accelerate the cost reduction and efficiency of lithium batteries for electric two-wheelers, strengthen the competitive advantage of lithium two-wheelers, and promote the further improvement of the penetration rate of lithium two-wheelers. C. The application scenarios of power tools continue to expand, the trend of cordless and foreign investment substitution work together, and the domestic power tool lithium battery market can be expected in the future Power tools are divided into professional grade and household grade, professional grade is mainly used in construction, maintenance, etc., while household grade focuses on the individual consumer market, including vacuum cleaners, sweeping robots, lawn mowers, snow blowers, scrubbers, etc. Traditional power tools are mainly driven by electric wiring, and there are many inconveniences and safety risks in use, such as looking for a power interface or its own generator, which may cause electric shock and overload. In contrast, cordless rechargeable power tools have outstanding advantages. Bosch introduced the world's first rechargeable power tool in 1969, but failed to popularize it on a large scale due to the heavy and poor performance of the accompanying lead-acid battery. With the development of battery technology, nickel-cadmium and nickel-metal hydride batteries have improved energy density and cycle performance to a certain extent, but the overall performance of cordless power tools still has a gap with wired power tools, so it has not become the mainstream. In recent years, lithium battery technology has made rapid progress in energy density, cycle life, charge and discharge ratio has obvious advantages, while more environmentally friendly, the price has continued to decline with the development of the electric vehicle industry, led by the leading enterprises led by TTI, lithium battery power tools have effectively accelerated the cordless change of power tools. Power tool batteries are mainly lithium batteries, and gradually replace nickel-metal hydride and nickel-cadmium batteries. In 2019, the global lithium battery accounted for nearly 87% of cordless power tools. Power tools with lithium battery cylindrical battery as the mainstream, mainly due to the stable performance of the cylindrical battery process, flexible size, convenient assembly, while easy to achieve large-scale production, very suitable for a variety of products, different forms of power tools production, so domestic and foreign enterprises cordless electric tools supporting the battery cell are based on cylinders. According to EVTank and Ivey Economic Research Institute data, the global power tool shipments and market size in 2022 are expected to be 510 million and 57.19 billion US dollars, respectively, and it is expected that by 2026, the global power tool shipments will exceed 700 million units and the market size will exceed 80 billion US dollars. Driven by the growth of the global power tools market, it is expected that the global demand for lithium batteries for power tools will exceed 4 billion in 2026. In the future, the driving factors that continue to promote the growth of the domestic power tool lithium battery market are mainly the following three aspects: a. The market for power tools continues to expand With the needs of consumers in different areas have been explored, power tool manufacturers continue to open up new product lines, and the power tool market has maintained a continuous growth trend in recent years. According to AlliedMarketResearch statistics, the global power tools market size was $23.60 billion in 2019 and is expected to reach $39.15 billion by 2027, with a compound annual growth rate of 6.53%. b. The penetration rate of cordless power tools has been further improved The further increase in the penetration rate of cordless power tools is mainly due to: (a) Due to environmental issues, the new regulations of the European Union in 2017 completely banned the use of nickel-cadmium batteries for wireless power tools; (b) Compared with lithium batteries, nickel-metal hydride batteries have lower energy density, poor low temperature performance, and problems such as self-discharge; (c) Lithium batteries have high energy density, large capacity and good cycle life, which can meet the trend of high doubling rate and portability of power tools. c. The focus of expansion of foreign manufacturers has shifted to large power batteries, and domestic cylindrical lithium battery manufacturers have accelerated replacement Due to the huge power battery market space, the supply and demand gap is expected to be large in the next few years, foreign enterprises focus on expanding production layout of lithium batteries for new energy vehicles, and when the cylindrical lithium battery manufacturers are frustrated in the field of large power, they turn to the field of power tools for layout. At present, the lithium battery suppliers such as Yi Wei Lithium Energy, Li Shen Battery, Bic battery have respectively passed the certification of TTI, Bosch, Stanley Black & Decker, Baoshide and other well-known power tool manufacturers. In summary, the domestic lithium battery market for power tools is expected to continue to expand. ② Emerging consumer electronics drive lithium battery shipments, and consumption of lithium batteries will grow steadily Consumer electronics mainly include smart phones, laptops, tablets and smart hardware. With the rapid development of integrated circuits and Internet of Things technology, the functions of consumer electronic products are increasingly powerful, and the application scenarios are constantly expanded, and they have gradually become an indispensable necessity for People's Daily life, office and entertainment. According to IDC data, from 2009 to 2019, the global consumer electronics industry market size rapidly increased from $245 billion to $715 billion, with a compound annual growth rate of 11.3%. Affected by factors such as the tide of 5G smartphone replacement, the normalization of online learning and telecommuting demand for laptops, and the continuous launch of emerging smart hardware devices, the consumer electronics market is expected to maintain steady growth in the future, and the market size will reach $939 billion in 2025. With the rapid development of the consumer electronics industry, the rapid growth of consumer lithium battery shipments, according to China Energy storage network data, in 2021 China's consumption of lithium battery production of 72GWh, to achieve an increase of 18%. In the future, the lightweight and high-performance requirements of consumer electronic products continue to improve, putting forward new requirements for the battery life and charging speed of consumer lithium batteries, GGII expects that the demand for consumer lithium batteries will continue to grow, and the annual growth rate will remain between 5%-10%. ③ Energy storage application scenarios on the power generation side, the power grid side and the user side are expanded, and the development potential of the energy storage lithium battery market is huge The energy storage lithium battery industry has great potential for development, but due to technology, policy, cost and other reasons, China's energy storage lithium battery market started relatively late. At present, China's energy storage lithium batteries are mainly used in communication base stations, user side peaking and valley filling, off-grid power stations, microgrids, rail transit, etc., and some are also exported to Southeast Asia, Europe and the United States, Australia and other markets. As one of the key supports for peaking carbon neutrality in the energy field, the new energy storage industry is a direction strongly supported by the state. In August 2021, the National Development and Reform Commission and the National Energy Administration jointly issued the "Guiding Opinions on Accelerating the Development of New Energy Storage", which clearly stated that the main goal is to achieve more than 30 million kilowatts of new energy storage installed capacity by 2025. By 2030, we will realize the comprehensive market-oriented development of new energy storage. Among them, the above opinions clearly require that the cost of relatively mature new energy storage technologies such as lithium batteries continue to decline and commercial-scale applications. Therefore, with the implementation of relevant supporting policies, the lithium battery industry chain related to new energy storage will usher in greater market opportunities. According to GGII statistics, China's energy storage battery market shipments in 2022 have grown rapidly from 16.2GWh in 2020 to 130GWh, with a compound annual growth rate of 183.28%. Among them, electric energy storage, home energy storage, portable energy storage increased by 216.2%, 354.5% and 207.7%, respectively. In the future, with the implementation of relevant supporting policies, the overlay of new energy grid connection, the increase of new energy consumption market demand on the power generation side, and the impact of 5G commercial application, China's energy storage lithium battery market will be further expanded. 4, the competitive landscape of the lithium battery industry ① The overall industry competition pattern of cylindrical lithium battery manufacturers According to the "White Paper on the Development of China's cylindrical lithium-ion Battery Industry (2022)" released by EVTank, the global cylindrical lithium battery industry has a relatively high concentration, and the top 9 cylindrical lithium battery manufacturers account for about two-thirds of the market share. The top manufacturers are Panasonic Group, LG Chemical, Samsung SDI, Yi Wei Lithium Energy, Tianpeng power supply, Bic battery, Sunpower, Lishen battery, Highstar. ② Industry competition pattern of lithium battery manufacturers in each subdivision application field From the perspective of regional distribution, after years of policy encouragement, China's lithium battery industry has developed rapidly, Panasonic, LG Chemical, Samsung SDI and other major foreign lithium battery manufacturers have production bases in China, and China has become one of the world's most important lithium battery production areas. From the perspective of market segments, there are differences between the leading enterprises in the application fields of power lithium batteries, consumer lithium batteries, and energy storage lithium batteries, but the overall pattern is almost oligopoly. The competition pattern of each segment is as follows: A. Competitive landscape of power lithium batteries a. Automotive power battery field In the field of automotive power lithium batteries, domestic enterprises are in a relatively leading position in the field of automotive power lithium batteries, and the oligarchic pattern of the head enterprises of China, Japan and South Korea has basically formed. According to statistics, in 2021, Chinese enterprises Ningde Times, South Korean enterprises LG Chemical, Japanese enterprises Panasonic, Chinese enterprises BYD and South Korean enterprises SKI respectively occupied the top five power battery installed capacity, the top five enterprises combined market share of about 80%, has formed a relatively stable oligopoly pattern. b. Electric light vehicle power lithium battery field In terms of lithium batteries for electric light vehicles (mainly electric two-wheelers), EVTank data shows that the output of lithium two-wheelers in 2021 is 13.17 million, with an overall penetration rate of 24.2%, driving the shipment of lithium-ion batteries for electric two-wheelers to 13.1GWh. From the perspective of the competitive landscape, according to the "White Paper on the Development of China's electric two-wheeled vehicle Industry (2022)" released by EVTank, the main domestic electric two-wheeled lithium battery suppliers in 2021 are Xingheng Power supply, Tianneng shares, Xinneng An and Chaowei batteries, and the total share of the four enterprises exceeds 70%. In addition, the industry's competitors also include Ningde Times, Far East Shares, Hengdian Dongmagnetic, Bic cell, Yiwei Lithium Energy, Penghui Energy, Lishen battery and so on. c. Power tool power lithium battery field In terms of lithium batteries for power tools, according to EVTank and Ivey Economic Research Institute data, the global power tool shipments and market size in 2022 are expected to be 510 million and 57.19 billion US dollars, respectively, and it is expected that by 2026 the global power tool shipments will exceed 700 million units, and the market size will exceed 80 billion US dollars. Driven by the increase in the global power tools market, it is expected that the global demand for lithium batteries for power tools will exceed 4 billion in 2026. From the perspective of the competitive landscape, international lithium battery manufacturers started earlier and occupied a larger market space: in 2017, Samsung SDI, LG Chemical, Murata accounted for about 75% of the market share in the field of power tool batteries. Since 2018, under the background of the continuous breakthrough of domestic high-rate lithium battery technology and the focus of international lithium battery manufacturers in the field of automotive power batteries, Many domestic lithium battery suppliers such as Yi Wei Lithium Energy, Li Shen Battery, Bak battery, Tianpeng Power supply have passed the certification of one or more well-known power tool manufacturers such as TTI, Bosch, Stanley Black & Decker, and Baoshi, and have entered the supply chain of international power tool manufacturers, gradually replacing the share of foreign battery manufacturers. According to EVTank data, in terms of the penetration rate of all-lithium electric two-wheeled vehicles in 2021, the "new national standard" and well-known enterprises will become the long-term help to accelerate the replacement of lithium batteries with lead-acid batteries. On the one hand, the official implementation of the "Safety Technical Specifications for Electric Bicycles" and "General Technical Conditions for electric Motorcycles and electric mopeds" in April 2019 has made specific requirements for the vehicle mass, battery voltage, motor power and maximum speed of electric two-wheelers, among which the mass of electric bicycles is required to be no more than 55kg. Ultra-specification vehicles will be regarded as electric motorcycles or electric light motorcycles and other motor vehicles for management, the use of the threshold has been significantly increased, one is that the driver needs to have a driving license, the second is that the difficulty of obtaining vehicle licenses has also increased. At present, the weight of lead-acid battery electric bicycle is generally more than 70kg, the weight of lead-acid battery is about 20kg, under the existing technology conditions, the weight of the same capacity lithium battery is only one-fifth of the lead-acid battery, the use of lithium battery can reduce the mass of the vehicle by more than 10kg. For end consumers, continuing to use bicycles equipped with lead-acid batteries will face a dilemma: choose electric (light) motorcycles with longer driving range, higher qualification requirements and stricter management; Or choose to sacrifice the range to meet the "new national standard" requirements. Therefore, the weight requirements of the new national standard for electric bicycles accelerate the replacement of lithium batteries for lead-acid batteries. On the other hand, many industry-leading battery companies have begun to lay out the field of electric two-wheelers. On the one hand, traditional lead-acid battery giants Tianneng Shares and Chaowei batteries have laid out lithium battery production capacity and made technical reserves for the replacement of lead-acid batteries by lithium batteries; On the other hand, lithium battery head companies, including Ningde Times, Lishen, Guoxuan High-tech, BYD, and Bic batteries, are actively laying out the field of small power cylinder batteries. The participation of relevant enterprises will accelerate the cost reduction and efficiency of lithium batteries for electric two-wheelers, strengthen the competitive advantage of lithium two-wheelers, and promote the further improvement of the penetration rate of lithium two-wheelers. C. The application scenarios of power tools continue to expand, the trend of cordless and foreign investment substitution work together, and the domestic power tool lithium battery market can be expected in the future Power tools are divided into professional grade and household grade, professional grade is mainly used in construction, maintenance, etc., while household grade focuses on the individual consumer market, including vacuum cleaners, sweeping robots, lawn mowers, snow blowers, scrubbers, etc. Traditional power tools are mainly driven by electric wiring, and there are many inconveniences and safety risks in use, such as looking for a power interface or its own generator, which may cause electric shock and overload. In contrast, cordless rechargeable power tools have outstanding advantages. Bosch introduced the world's first rechargeable power tool in 1969, but failed to popularize it on a large scale due to the heavy and poor performance of the accompanying lead-acid battery. With the development of battery technology, nickel-cadmium and nickel-metal hydride batteries have improved energy density and cycle performance to a certain extent, but the overall performance of cordless power tools still has a gap with wired power tools, so it has not become the mainstream. In recent years, lithium battery technology has made rapid progress in energy density, cycle life, charge and discharge ratio has obvious advantages, while more environmentally friendly, the price has continued to decline with the development of the electric vehicle industry, led by the leading enterprises led by TTI, lithium battery power tools have effectively accelerated the cordless change of power tools. Power tool batteries are mainly lithium batteries, and gradually replace nickel-metal hydride and nickel-cadmium batteries. In 2019, the global lithium battery accounted for nearly 87% of cordless power tools. Power tools with lithium battery cylindrical battery as the mainstream, mainly due to the stable performance of the cylindrical battery process, flexible size, convenient assembly, while easy to achieve large-scale production, very suitable for a variety of products, different forms of power tools production, so domestic and foreign enterprises cordless electric tools supporting the battery cell are based on cylinders. According to EVTank and Ivey Economic Research Institute data, the global power tool shipments and market size in 2022 are expected to be 510 million and 57.19 billion US dollars, respectively, and it is expected that by 2026, the global power tool shipments will exceed 700 million units and the market size will exceed 80 billion US dollars. Driven by the growth of the global power tools market, it is expected that the global demand for lithium batteries for power tools will exceed 4 billion in 2026. In the future, the driving factors that continue to promote the growth of the domestic power tool lithium battery market are mainly the following three aspects: a. The market for power tools continues to expand With the needs of consumers in different areas have been explored, power tool manufacturers continue to open up new product lines, and the power tool market has maintained a continuous growth trend in recent years. According to AlliedMarketResearch statistics, the global power tools market size was $23.60 billion in 2019 and is expected to reach $39.15 billion by 2027, with a compound annual growth rate of 6.53%. b. The penetration rate of cordless power tools has been further improved The further increase in the penetration rate of cordless power tools is mainly due to: (a) Due to environmental issues, the new regulations of the European Union in 2017 completely banned the use of nickel-cadmium batteries for wireless power tools; (b) Compared with lithium batteries, nickel-metal hydride batteries have lower energy density, poor low temperature performance, and problems such as self-discharge; (c) Lithium batteries have high energy density, large capacity and good cycle life, which can meet the trend of high doubling rate and portability of power tools. c. The focus of expansion of foreign manufacturers has shifted to large power batteries, and domestic cylindrical lithium battery manufacturers have accelerated replacement Due to the huge power battery market space, the supply and demand gap is expected to be large in the next few years, foreign enterprises focus on expanding production layout of lithium batteries for new energy vehicles, and when the cylindrical lithium battery manufacturers are frustrated in the field of large power, they turn to the field of power tools for layout. At present, the lithium battery suppliers such as Yi Wei Lithium Energy, Li Shen Battery, Bic battery have respectively passed the certification of TTI, Bosch, Stanley Black & Decker, Baoshide and other well-known power tool manufacturers. In summary, the domestic lithium battery market for power tools is expected to continue to expand. ② Emerging consumer electronics drive lithium battery shipments, and consumption of lithium batteries will grow steadily Consumer electronics mainly include smart phones, laptops, tablets and smart hardware. With the rapid development of integrated circuits and Internet of Things technology, the functions of consumer electronic products are increasingly powerful, and the application scenarios are constantly expanded, and they have gradually become an indispensable necessity for People's Daily life, office and entertainment. According to IDC data, from 2009 to 2019, the global consumer electronics industry market size rapidly increased from $245 billion to $715 billion, with a compound annual growth rate of 11.3%. Affected by factors such as the tide of 5G smartphone replacement, the normalization of online learning and telecommuting demand for laptops, and the continuous launch of emerging smart hardware devices, the consumer electronics market is expected to maintain steady growth in the future, and the market size will reach $939 billion in 2025. With the rapid development of the consumer electronics industry, the rapid growth of consumer lithium battery shipments, according to China Energy storage network data, in 2021 China's consumption of lithium battery production of 72GWh, to achieve an increase of 18%. In the future, the lightweight and high-performance requirements of consumer electronic products continue to improve, putting forward new requirements for the battery life and charging speed of consumer lithium batteries, GGII expects that the demand for consumer lithium batteries will continue to grow, and the annual growth rate will remain between 5%-10%. ③Energy storage application scenarios on the power generation side, the power grid side and the user side are expanded, and the development potential of the energy storage lithium battery market is huge The energy storage lithium battery industry has great potential for development, but due to technology, policy, cost and other reasons, China's energy storage lithium battery market started relatively late. At present, China's energy storage lithium batteries are mainly used in communication base stations, user side peaking and valley filling, off-grid power stations, microgrids, rail transit, etc., and some are also exported to Southeast Asia, Europe and the United States, Australia and other markets. As one of the key supports for peaking carbon neutrality in the energy field, the new energy storage industry is a direction strongly supported by the state. In August 2021, the National Development and Reform Commission and the National Energy Administration jointly issued the "Guiding Opinions on Accelerating the Development of New Energy Storage", which clearly stated that the main goal is to achieve more than 30 million kilowatts of new energy storage installed capacity by 2025. By 2030, we will realize the comprehensive market-oriented development of new energy storage. Among them, the above opinions clearly require that the cost of relatively mature new energy storage technologies such as lithium batteries continue to decline and commercial-scale applications. Therefore, with the implementation of relevant supporting policies, the lithium battery industry chain related to new energy storage will usher in greater market opportunities. According to GGII statistics, China's energy storage battery market shipments in 2022 have grown rapidly from 16.2GWh in 2020 to 130GWh, with a compound annual growth rate of 183.28%. Among them, electric energy storage, home energy storage, portable energy storage increased by 216.2%, 354.5% and 207.7%, respectively. In the future, with the implementation of relevant supporting policies, the overlay of new energy grid connection, the increase of new energy consumption market demand on the power generation side, and the impact of 5G commercial application, China's energy storage lithium battery market will be further expanded. 5. Characteristics of the lithium battery industry ① The safety problem of lithium battery needs to be solved urgently Under the background that the replacement trend of new energy vehicles to traditional fuel vehicles is basically determined, lithium batteries are the main power batteries used by electric vehicles at present with their advantages of high energy density, high discharge power and long cycle life. However, in recent years, safety accidents caused by thermal runaway of lithium batteries have occasionally occurred, posing a threat to the life and property safety of consumers. In order to deal with the safety problem of lithium batteries and promote the healthy development of strategic emerging industries such as new energy vehicles in China, China has announced the mandatory national standard of "Safety Requirements for power batteries for electric Vehicles", which has been implemented since 2021 and requires strict safety testing of lithium batteries before leaving the factory. Including 6 battery cells and 15 safety tests of the battery system to ensure the safe use of lithium batteries. With the implementation of mandatory standards, the safety threshold of lithium batteries has been significantly improved, and the degree of guarantee of battery safety will be increasingly paid attention to by manufacturers, end users and government regulators, and how lithium battery companies will minimize the safety problem of lithium batteries is a challenge facing lithium batteries and related industries. ② Lithium battery a variety of technical routes coexist In recent years, the commercial application of lithium batteries has developed rapidly, and in order to cope with the increasing requirements of lithium batteries in the terminal application market such as new energy vehicles, emerging technologies of lithium batteries have emerged, showing the coexistence of a variety of technical routes. At present, the technical route differences of lithium batteries are mainly reflected in the positive electrode material system and packaging form. First, there are differences in the technical route of positive electrode materials for lithium batteries. Cathode material is an important part of lithium battery, and its characteristics have an important impact on the energy density, cycle life and safety performance of the battery. The technical route mainly includes ternary materials, lithium manganate, lithium iron phosphate, lithium cobalt oxide and so on. Battery precision structural parts and materials with their strong versatility can be widely used as packaging or conductive materials for lithium batteries, generally not affected by the technical route of positive electrode materials. Second, there are differences in the packaging forms of lithium batteries. The packaging form refers to the packaging structure of a single lithium battery, and different packaging forms should be different processes, and also correspond to different forms of battery precision structural parts. At present, the technical route of lithium battery packaging form mainly includes three forms: cylinder, square and soft package At present, the cylinder, square and soft pack three types of lithium battery characteristics have their advantages and disadvantages, in the global market is a "three parts of the world" competition pattern, have a large market development space. In September 2020, Tesla launched the 46800 large cylinder battery solution. Compared with the traditional small cylinder battery, the large cylinder battery technology can reduce the number of batteries in the battery pack and the corresponding number of structural parts, improve the energy density, and simplify the disadvantage of the battery management system requirements than the square battery. Judging from the current progress, in 2022, Tesla has achieved the mass production of 4,680 large cylinder batteries, and the weekly production capacity has reached 868,000, which corresponds to the demand of about 1,000 ModelY. In September 2022, the BMW Group announced the use of 46 series cylindrical cells in its new models from 2025, and the first partners were locked into Ningde Times and Yi Wei Lithium Energy. Other well-known battery manufacturers at home and abroad are also steadily advancing the 4680 cylinder battery layout. (Source: Sihan Industrial Research Institute) |