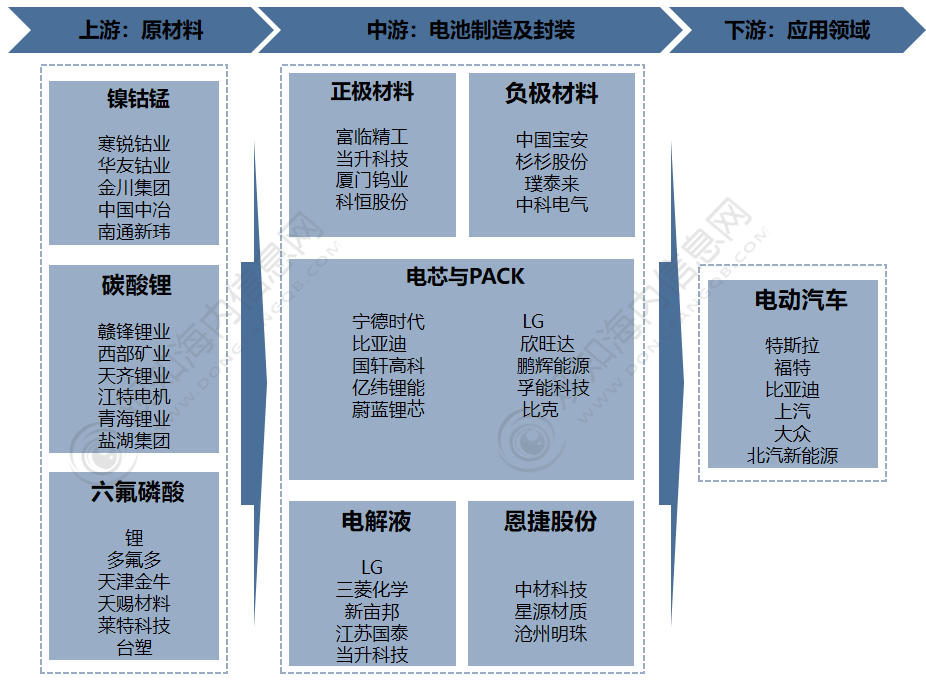

Domestic consulting: Industry Report! 2023 China power lithium battery industry market status analysIssuing time:2023-10-09 12:52 First, power lithium battery definition and industry chain Power lithium-ion battery refers to the capacity of more than 3AH lithium-ion battery, at present it generally refers to the lithium-ion battery that can be driven by discharge to equipment, instruments, models, vehicles, etc., due to the different use of objects, the capacity of the battery may not reach the level of unit AH. In the industrial chain of power lithium batteries, the upstream is mainly based on carbon, cobalt, lithium manganate, graphite and other raw materials; The middle reaches are positive and negative, electrolyte, diaphragm, etc., which account for the largest proportion of cost in the entire power lithium battery industry chain; The downstream applications of new energy vehicles are mainly electric vehicles, electric bicycles, electric motorcycles and so on. China power lithium battery industry chain diagram

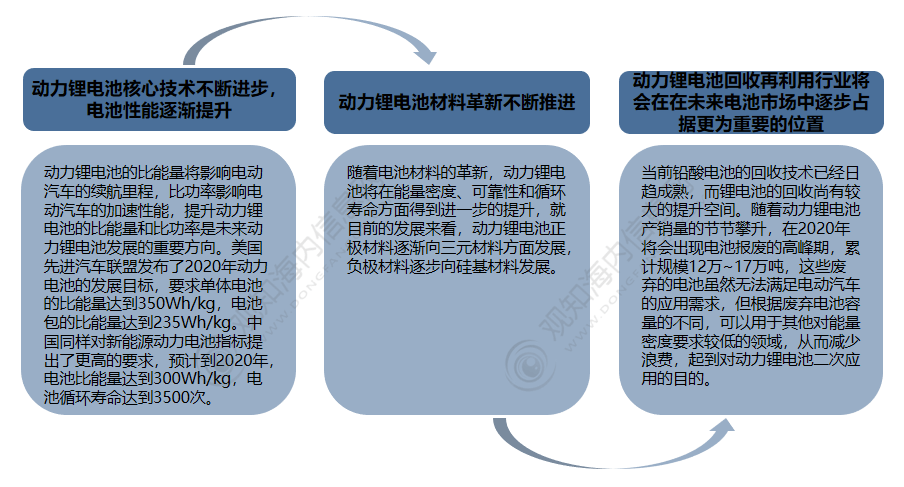

Source: Guanchi domestic consulting collation Power lithium battery core technology continues to improve, battery performance gradually improves, power lithium battery material innovation continues to advance, power lithium battery recycling industry will gradually occupy a more important position in the future battery market. China's power lithium battery industry development trend

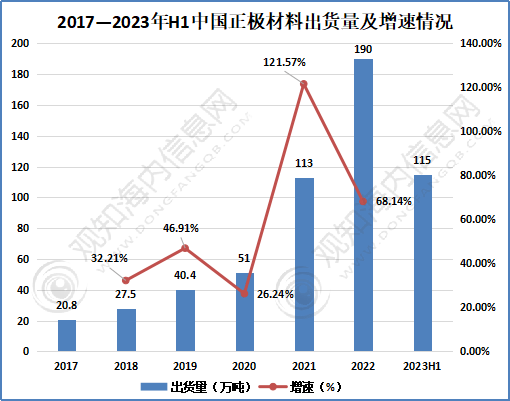

Source: Guanchi domestic consulting collation Source: Guanchi domestic consulting collation In recent years, China's power lithium battery industry has been highly valued by governments at all levels and the key support of national industrial policies. The state has introduced a number of policies to encourage the development and innovation of the power lithium battery industry, Industrial policies such as the "New Energy Vehicle power Battery echelon Utilization Management Measures", "Notice on the Issuance of a Special Action Plan for the Improvement of Manufacturing Design Capacity (2019-2022)", "New energy Vehicle Industry Development Plan (2021-2035)" provide a clear and broad market prospect for the development of the power lithium battery industry. It provides a good production and operation environment for enterprises. Second, upstream end analysis The positive electrode material is lithium ion positive electrode material, which is an important part of lithium ion battery, as a lithium ion source, and has a high electrode potential, so that the battery has a high open circuit voltage; The positive electrode material accounts for the highest proportion of the total cost of lithium-ion batteries, about 30%-40%, and its performance directly affects the energy density, safety, cycle life and other core performance indicators of lithium-ion batteries. With the rapid development of the downstream consumer market for lithium batteries such as consumer electronics, new energy vehicles, and energy storage in China in recent years, the market demand for lithium batteries and their upstream materials has also increased rapidly, which has promoted the rapid development of China's cathode material industry. According to the data, in 2022, China's positive electrode material shipments reached 1.9 million tons, an increase of 68.14%; 2023H1 China's positive electrode material shipments of 1.15 million tons, an increase of 50%. 2017-2023 H1 positive electrode material shipments and growth rate in China

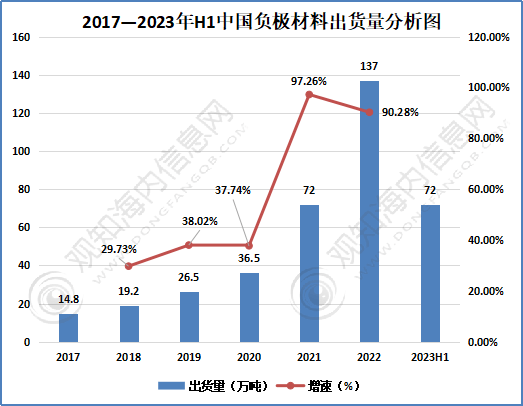

Source: GGII Domestic Consulting Organization (Domestic Information Network) Negative material refers to the raw materials that constitute the negative electrode in the battery, negative material as one of the key materials of lithium-ion battery, accounting for about 6%-10% of the cost of lithium-ion battery, the material mainly affects the first efficiency of lithium-ion battery, cycle performance, etc., so the performance of negative material will directly affect the performance of lithium-ion battery. In recent years, anode material shipments have grown steadily, artificial graphite market share has increased, and industry concentration has increased. The market size of negative electrode materials in China increased from 148,000 tons in 2017 to 366,000 tons in 2020. In 2021, China's negative electrode material shipments are expected to be about 720,000 tons, an increase of about 100%, and shipments in 2022 will be 1.37 million tons; H1 is expected to ship 720,000 tons by 2023, an increase of 18%. 2017-2023 H1 China negative electrode material shipment analysis chart

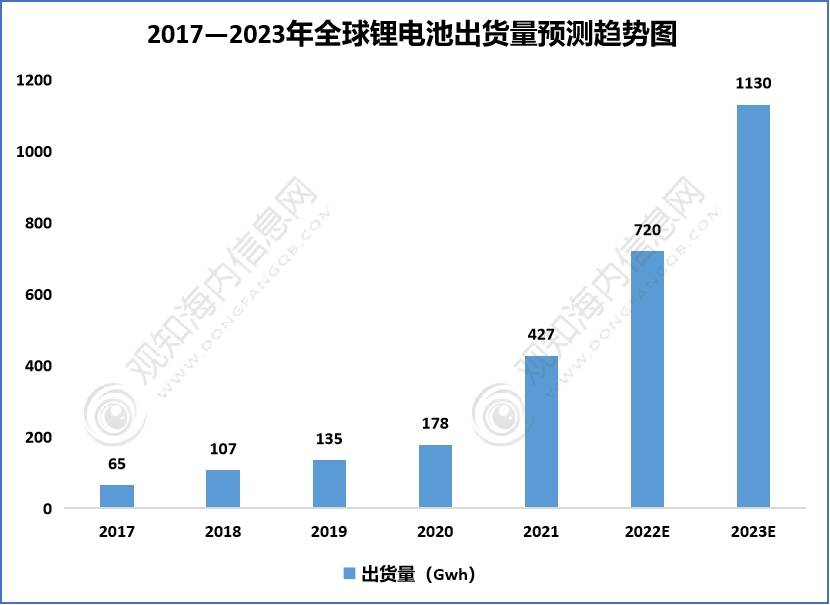

Source: GGII Domestic Consulting Organization (Domestic Information Network) Third, the status of the global power lithium battery industry Benefiting from the rapid development of the global electric vehicle consumer market, the demand for power lithium batteries is huge. In the context of the global efforts to promote the electrification of vehicles, the development potential of the global power lithium battery field is broad. Data show that the global power lithium battery shipments from 2017 65GWh growth to 2021 427GWh, a compound annual growth rate of 60.1%, is expected to 2023 global power lithium battery shipments will reach 1130GWh. Forecast trend chart of global lithium battery shipments from 2017 to 2023

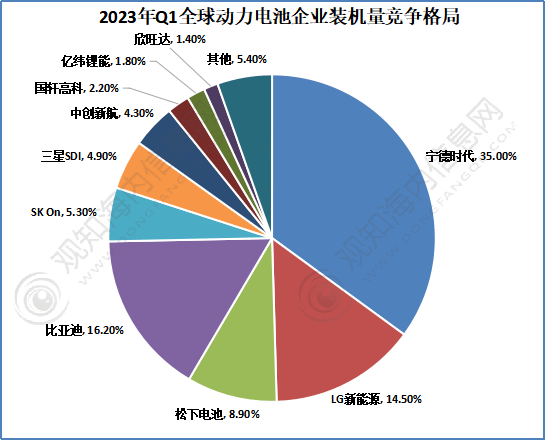

Source: Guanchi Domestic Consulting Organization (Guanchi Domestic Information Network) The competitiveness of domestic enterprises has been significantly strengthened: Ningde Era occupies more than 1/3 of the global market share and the market share remains relatively stable; Byd with blade battery and automotive manufacturing integration layout rapid expansion, ranking from the fourth to the second; The proportion of ZhongChuang new airlines has increased year by year and developed rapidly. In 2023Q1, Yiwei Lithium Energy occupied the top ten for the first time, and the market share of 2023Q1 reached 1.8%, with development potential. 2023 Global power battery enterprise installed capacity competition pattern proportion statistics

Source: SNE Research Guanchi Domestic Consulting Collation (Guanchi Domestic Information Network) Fourth, China's power lithium battery market status Data show that in 2017, China's power lithium battery production was 36.4GWh, by the rapid development of new energy vehicles and power lithium battery production and research and development technology to improve, in 2020 China's power lithium battery production increased to 83.4GWh. In the context of "double carbon", 2021 vigorously advocate low-carbon environmental protection development, the latest data show that from January to December 2021, China's power battery production accumulated 219.7GWh, a cumulative increase of 163.4%. In 2022, China's power battery production and sales will increase exponentially. The annual cumulative output of 545.9GWh, a cumulative increase of 148.5%. Among them, the cumulative output of ternary batteries is 212.5GWh, accounting for 38.9% of the total output, with a cumulative increase of 126.4%. The cumulative production of lithium iron phosphate batteries is 332.4GWh, accounting for 60.9% of the total production, and a cumulative increase of 165.1%. 2017-2022 China power lithium battery production statistics

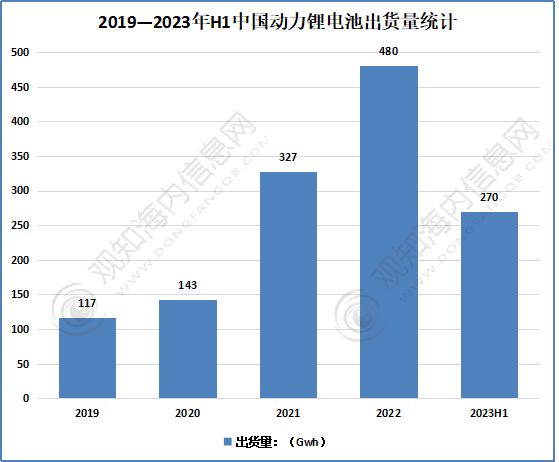

Source: China Automotive Power Battery Industry Innovation Alliance Guanchi (Guanchi Domestic Information Network) In 2022, China's lithium battery market shipments reached 658GWh, an increase of 101.1%. As of 2023H1, China's new energy vehicle sales volume of 3.747 million, an increase of 44.1%, driving China's power battery shipments to 270GWh, an increase of 33%. It is expected that by 2023, China's lithium battery shipments will exceed 600GWH, mainly from the continuous growth of power lithium batteries and energy storage lithium battery demand. H1 China power lithium battery shipment statistics from 2019 to 2023

Source: GGII Domestic Consulting Organization (Domestic Information Network) From January to December 2021, China's power battery loading capacity accumulated 154.5GWh, an increase of 142.8%. The explosive growth of new energy vehicles will continue to drive the growth of power battery installations. According to the data of the China Automotive Power Battery Industry Innovation Alliance, in 2022, China's power battery accumulated 294.6GWh, a cumulative increase of 90.7%. In March 2023, China's power battery loading capacity was 27.8GWh, an increase of 29.7% year-on-year and 26.7% month-on-month. Among them, the ternary battery load of 8.7GWh, accounting for 31.4% of the total load, an increase of 6.3%, an increase of 29.8%; Lithium iron phosphate battery load 19.0GWh, accounting for 68.5% of the total load, an increase of 44.4%, an increase of 25.3%. From January to March, China's cumulative load of power batteries was 65.9GWh, a cumulative increase of 28.4%. 2017-2023 March China's power battery load statistics

Source: China Automotive Power Battery Industry Innovation Alliance Guanchi (Guanchi Domestic Information Network) Five, power lithium battery industry development prospects China has introduced a number of new energy vehicle encouragement policies, clearly support the development of new energy vehicles, and promote the new energy automobile industry to the focus of the "Fourteenth Five-Year Plan" government industry support development, carrying the important mission of China's automobile industry to achieve "curve overtaking". At present, China has established a relatively complete policy support system for the new energy automobile industry from research and development, production, purchase, use to infrastructure, etc., which is conducive to the further development of the new energy automobile industry. At the same time, in view of the environmental pollution caused by the automobile industry, more and more cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Tianjin, Hangzhou and other first and second tier cities have begun to restrict the purchase and driving of traditional fuel passenger vehicles, which also helps to increase the demand for new energy vehicles. With the rapid development of China's economy and the continuous rise of car ownership, the problem of environmental pollution has become increasingly prominent, and people's demand for new clean energy is becoming more and more urgent. The environmental problems caused by the exhaust gas emitted by traditional vehicles have directly intensified people's desire for the application of new energy. China's automobile industry through technological innovation, industrial transformation, new energy development and other means to develop a low-pollution, low-emission based new energy automobile industry, is an important way to achieve sustainable economic development. In terms of the market demand for lithium batteries, the field of power batteries for new energy vehicles is undoubtedly a huge potential growth point. China's natural resources are rich in coal, poor oil and less gas, and its dependence on crude oil is high. Reducing motor vehicle fuel consumption and maintaining national energy security are the hard constraints for the development of the automobile industry. Coupled with the developed power industry in China, "replacing oil with electricity" is the long-term trend of the development of the automobile industry. In recent years, in the case of the depletion of oil resources, countries have issued a ban on the sale of fuel vehicles. Under the environment of the implementation of the double points policy in China and the restriction of driving in major cities, new energy vehicles have become the main trend of the future development of the global automobile market. As the core component of new energy vehicles, the market demand for power lithium batteries will inevitably grow rapidly. As a key technology for clean energy and sustainable transportation, power lithium batteries are leading the transformation of the automotive and energy industries. With the enhancement of environmental awareness and the support of new energy policies, the power lithium battery industry will usher in a series of development trends, shaping the future pattern of energy and transportation. Energy density: The energy density of power lithium batteries is an important indicator of the range and performance of electric vehicles. In the future, researchers will continue to work to improve the battery's chemical composition, electrode materials and structural design to improve energy density, achieve longer driving range and higher performance. Cost reduction: At present, the cost of power lithium batteries is still one of the main factors restricting the popularity of electric vehicles. With the continuous progress of technology, the expansion of production scale and the optimization of manufacturing processes, it is expected that the cost of power lithium batteries will gradually decrease, improving the competitiveness of electric vehicles. Improvement of safety and stability: The safety of batteries has always been a focus of research. In the future, the thermal management of the battery, the development of the battery management system (BMS), and the safety testing of the battery material will be strengthened to ensure that the battery can remain stable and safe under various conditions. Fast charging technology: Improving the fast charging performance of the battery and shortening the charging time is the key to enhancing the user experience of electric vehicles. New charging technologies and the construction of fast charging networks will further promote the development of electric vehicles. Environmental sustainability: In the manufacturing process of power lithium batteries, environmental pollution and resource waste are a matter of concern. In the future, the research and development of renewable materials and environmentally friendly production processes will be promoted to reduce the environmental impact of battery manufacturing. The power lithium battery industry is in a stage of rapid development, and will continue to pursue higher energy density, lower costs, higher safety and a wider range of applications in the future. These trends will play an important role in driving the development of electric vehicles, energy storage systems, and clean energy, contributing to the realization of sustainable energy and transportation. (Source: Guanchui) |